AARP’s recent article entitled “Sign These Papers” suggests that the following documents will give you and your family financial protection, as well as peace of mind.

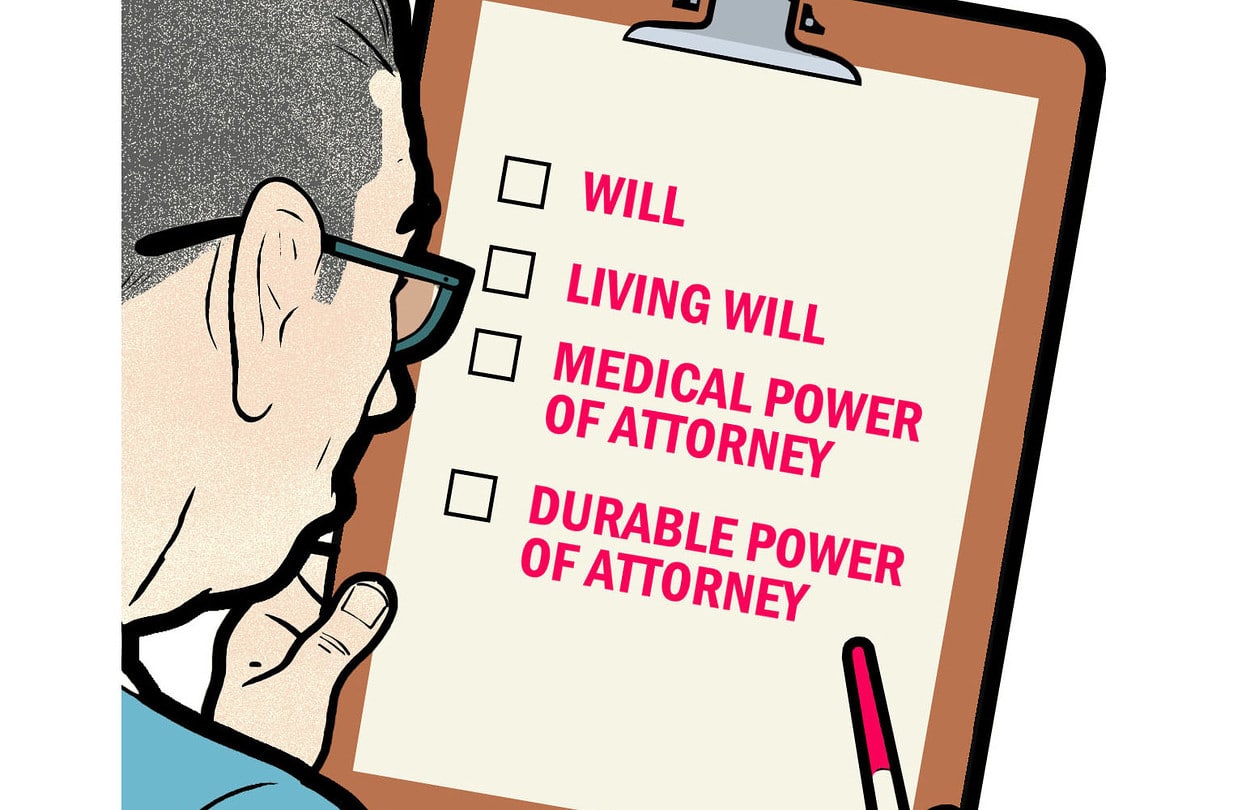

Advance Directive. This document gives your family, loved ones and medical professionals your instructions for your health care. A living will, which is a kind of advance directive, details the treatment you’d like to have in the event you’re unable to speak. It covers things like when you would want doctors to stop treatment, pain relief and life support. Providing these instructions helps your family deal with these issues later.

Durable Power of Attorney for Health Care. This document, regularly included in an advance directive, lets you name a trusted person (plus a backup or two) to make medical decisions on your behalf, when you’re unable to do so.

Revocable Living Trust. Drawn up correctly by an experienced estate planning attorney, this makes it easy to keep track of your finances now, allow a trusted person step in, if necessary, and make certain that there are fewer problems for your heirs when you pass away. A revocable living trust is a powerful document that allows you to stay in control of all your finances as long as you want. You can also make changes to your trust as often as you like.

When you pass away, your family will have a much easiest task of distributing the assets in the trust to your beneficiaries. Without this, they’ll have to go through the probate process. It can be a long and possibly costly process, if you die with only a will or intestate (i.e., without a will).

Will. Drafting a will with the guidance of an experienced estate planning attorney lets you avoid potential family fighting over what you’ve left behind. Your will can describe in succinct language whom you want to inherit items that might not be in your trust — your home or car, or specific keepsakes, such as your baseball card collection and your Hummel Figurines.

Durable Financial Power of Attorney. If you’re alive but incapacitated, the only way a trusted person, acting on your behalf, can access an IRA, pension or other financial account in your name is with a durable financial power of attorney. Many brokerages and other financial institutions have their own power of attorney forms, so make sure you ask about this.

These five documents (sometimes four, if your advance directive and health care power of attorney are combined) help you enjoy a happier, less stressful life.

In drafting these documents, you know that you’ve taken the steps to make navigating the future as smooth as possible. By making your intentions clear and easing the inheritance process as much as you possibly can, you’re taking care of your family. They will be grateful that you did.

Reference: AARP (August/September 2018) “Sign These Papers”